Risk Management

"Despite the downtrend of the equity market, using innovative proprietary risk models, Redexe was able to select, for its clients, portfolios that increased their value", Il Sole 24 ORE, 1/1/2012

Our financial risk management and reporting services are based on a proprietary risk measure, called RedES™, that is able to take into account of financial shocks and bubbles.

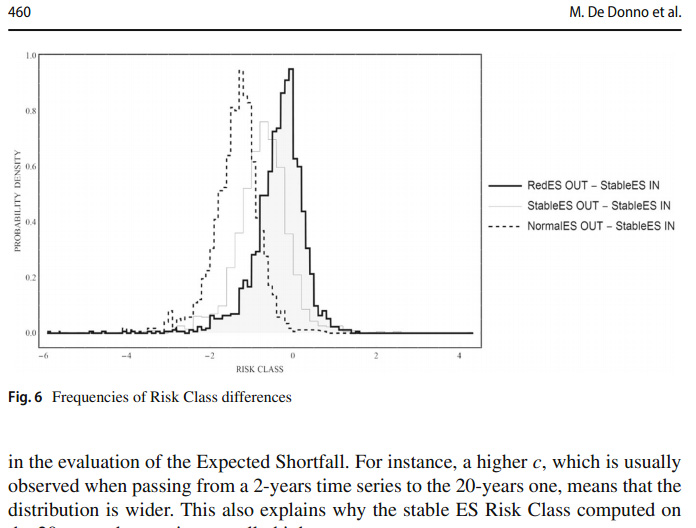

Using RedES™, we are able to offer consistent indications in both very high and very low volatility regimes, avoiding unnecessary shifts between risk classes and correctly estimating risk even when short time series are available only.

The first scientific publication of our risk measure was Donati, R., Corazza, M.: "RedES™, a risk measure in a Pareto Lévy stable framework with clustering.", Mathematical and Statistical Methods for Actuarial Sciences and Finance, pp. 91–94. Springer, Cham (2014)

Later, we fully presented our risk measure, testing its effectiveness on more than 3000 equity shares, in the international, peer reviewed paper De Donno, M., Donati, R., Favero, G. et al. "Risk estimation for short-term financial data through pooling of stable fits." Financ Mark Portf Manag 33, 447–470 (Springer US 2019) →

We proved that our Risk Measure is able to estimate financial risk much better than the ultra-diffused risk measures based on normal statistics, e.g., volatility, parametric VAR, and so on, that fail exactly when needed.

If you are an asset manager, a portfolio manager, an institution or a financial advisor, contact us for more, we will revert back to you soon! Please note that we do not serve natural persons.

Email...or you can keep in touch with the social networks hereafter.